96 provides that in life insurance the policy holder must have an insurable interest in the life or event. The policyholder is the son of the beneficiary his mother who lives in another country and has not talked to her son for years.

Chapter 11 Insurance Contracts Ppt Download

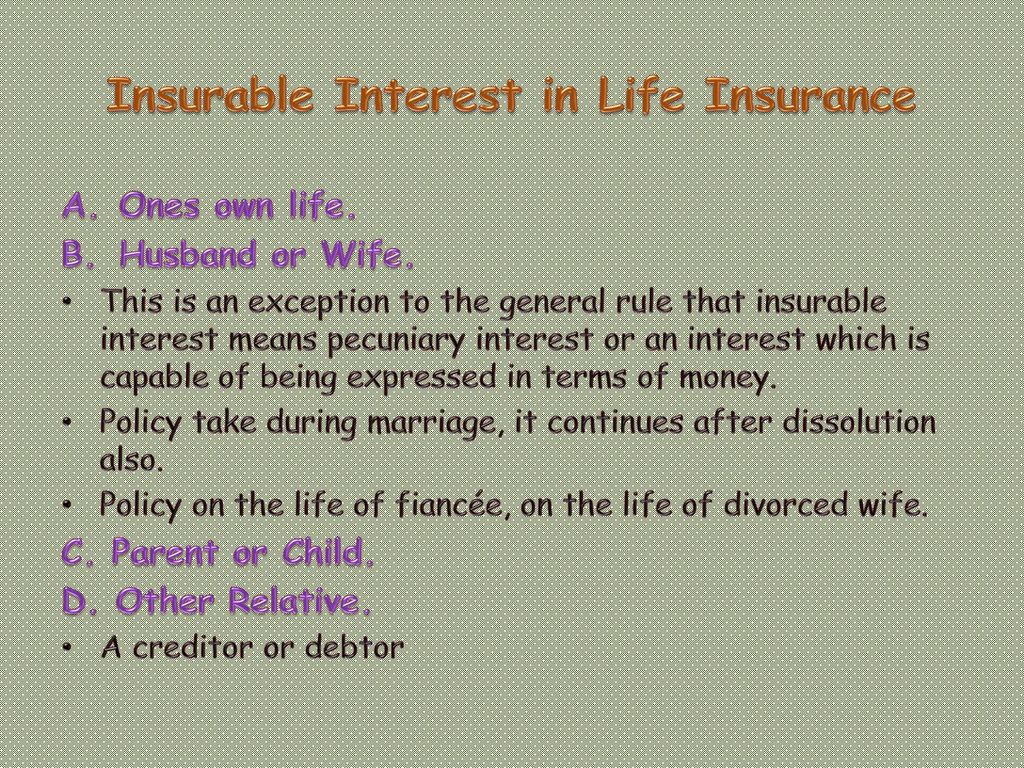

You are always considered to have an insurable interest in your own life and therefore you can purchase life insurance on yourself.

. The insured must have an insurable interest in the life to be insured for a valid contract insurable interest arises out of the pecuniary relationship that exists between the policy-holder and the life assured so that the former stands to lose by the death of the latter andor continues to gain by his survival. Regardless of the current situation between the two people parents children and spouses are considered. The person taking an insurance policy must have an insurable interest in the property or life insured.

In an Insurance Contract the term Insurable interest refers to the legal right to insure arising out of a financial relationship recognized at law between the insured and the subject matter. A trust is a legal entity and can be an owner of a life insurance policy named a beneficiary or both as long as the trust has an insurable interest to the insured. In Technically terms an insurable interest is a legal or equitable right or benefit acquired when the insured object damaged detriment or prejudice suffered on the happening or non-happening of the peril insured against.

It is however illegal for a person to purchase life insurance on the life of a person with whom they have no insurable interest. Therefore you can take out a life insurance policy on yourself and name whomever youd like as beneficiaries. Insurable interest in the life of ones spouse.

The insurable interest on ones own life is generally regarded as unlimited. This is because a person owner-insured is always considered to have an insurable interest in their own life and an owner-insured can generally name anyone they choose as beneficiary. A person or entity has an insurable interest in an item event or action when the damage or loss of.

Insurable interest is deemed to exist in certain cases for example a parent of a minor or a guardian of a minor on the life of minor spouses on each others lives etc. In life insurance it is important to prove insurable interest to protect both the insured as well as the insurer from insurance fraudA person must prove insurable interest in the application process by proving their relationship to the insured. Contingent on future earnings generally unlimited.

Insurable interest is a non-negotiable feature of life insurance plans. Insurable interest in ones life is legally considered as a. Moreover because the value of one s life and body cannot be measured by money a person has an unlimited interest in his own life18.

The policy buyer has to prove the existence of insurable interest. The insurable interest on ones own life is generally regarded as. Initiating life insurance on someone else without insurable interest is illegal.

Typically an insurable interest is automatically established by marriage or family relationship. If creating a trust-owned life insurance policy the trustee will be responsible for handling all owner signatures. Unlimited The contract type in which only one party is legally bound to its contractual obligations after a premium is paid is an _______________ contract.

Without this insurable interest the plan can be considered denied or void. Its presumed to exist between spouses children both natural and. You are considered to have an unlimited insurable interest in your own life.

Insurable interest in ones own life is legally considered as generally unlimited When must a producer provide disclosure about information practices to an applicant. In this case you would be the policyholder and the insured. Insurable interest is the pecuniary interest.

Under the Insurance Act 13 s. Insurable interest means that the policyholder benefits more if the insured person stays alive than if they pass away. This is an example of a viable insurable interest because the beneficiary and policyholder is part of a motherson relationship.

Therefore you can take out a life insurance policy on yourself and name whomever youd like as beneficiaries. Insurable interest is when a person or business would suffer from the loss of a person. You are considered to have an unlimited insurable interest in your own life.

The insurable interest on ones own life is generally regarded as. Any person item event or action can have insurable interest if its loss or damage results in a financial. Insurable interest is an investment with the intent to protect the purchaser from financial loss.

It is a fundamental prerequisite for any insurance policy. Insurable interest is a type of investment that protects anything subject to a financial loss. The Bottom Line.

Said another way you are at risk of financial loss if the insured were to pass away. Illegal in most states b. A person can take a policy to any unlimited amount on his own.

Proceeds are prorated to 112th to the full amount. South African textbooks generally expound and repeat the English rules on insurable interest necessary for life insurance17 Some important aspects of the English rules on insurable interest have indeed become firmly entrenched by trade usage and no turn-around seems possible eg. Insurable interest simply means an interest that can be quantified in monetary value.

Definitely has an insurable interest in his own life. Insurable interest in life insurance may be classified into two categories which are as follows - a Insurable Interest in Ones Own Life - Dalby Vs India and London Life Insurance Company in this case it was held that a creditor may insure debtors life and the policy remains valid even after the debtor has paid off the creditor. Time when the interest is required.

By virtue of art312 of the Insurance Law a person has an insurable interest in hisher spouse. The rule that a person may insure his or her own life. Life insurance coverage protects you against that loss.

In that context insurable interest exists when you are financially benefiting from the insureds ongoing health and safety. Insurable interest means that the policyholder benefits more if the insured person stays alive than if they pass away. A Dependent upon other assets the insured owns B 6 months salary C 1 years salary for each childdependent D Unlimited Answer D is correct.

Premium received by insurer is considered to be unearned c. Proof should be presented at the time of application and the end of the plan when the life assured dies.

What Is An Explanation Of An Insurable Interest With An Example Quora

Insurance For Home Read This Before You Choose Your Home Insurance Homeinsurance Insu Life Insurance Marketing Life Insurance Humor Life Insurance Facts

Understanding Insurable Interest In Life Insurance

/WhenMustInsurableInterestExistinaLifeInsurancePolicyMay262021-65b9b5a62d38425fbdaaa3a53f11397d.jpg)

When Must Insurable Interest Exist In A Life Insurance Policy

Insurable Interest Definition Types Example Explained

Principles Of Insurance Contract Ppt Download

How To Safeguard Your Business Against Natural Disasters Natural Disasters Family Life Insurance Disasters

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

0 Comments